Advertisement

-

Published Date

March 22, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

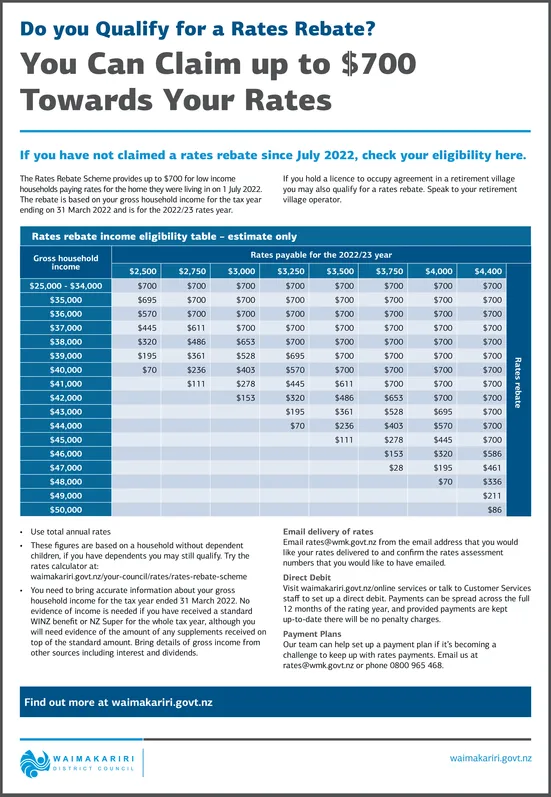

Do you Qualify for a Rates Rebate? You Can Claim up to $700 Towards Your Rates If you have not claimed a rates rebate since July 2022, check your eligibility here. The Rates Rebate Scheme provides up to $700 for low income households paying rates for the home they were living in on 1 July 2022. The rebate is based on your gross household income for the tax year ending on 31 March 2022 and is for the 2022/23 rates year. Rates rebate income eligibility table - estimate only Gross household income $25,000-$34,000 $35,000 $36,000 $37,000 $38,000 $39,000 $40,000 $41,000 $42,000 $43,000 $44,000 $45,000 $46,000 $47,000 $48,000 $49,000 $50,000 $2,500 $2,750 $3,000 $700 $700 $700 $695 $700 $700 $570 $700 $445 $611 $320 $195 $70 $486 $361 $236 $111 WAIMAKARIRI Find out more at waimakariri.govt.nz DISTRICT COUNCIL Rates payable for the 2022/23 year $3,250 $3,500 $3,750 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $695 $700 $570 $700 $611 Use total annual rates . These figures are based on a household without dependent children, if you have dependents you may still qualify. Try the rates calculator at: $700 $700 $653 waimakariri.govt.nz/your-council/rates/rates-rebate-scheme . You need to bring accurate information about your gross household income for the tax year ended 31 March 2022. No evidence of income is needed if you have received a standard WINZ benefit or NZ Super for the whole tax year, although you will need evidence of the amount of any supplements received on top of the standard amount. Bring details of gross income from other sources including interest and dividends. $528 $403 $278 $153 If you hold a licence to occupy agreement in a retirement village you may also qualify for a rates rebate. Speak to your retirement. village operator. $445 $320 $195 $70 $486 $361 $236 $111 $700 $700 $700 $700 $653 $528 $403 $278 $153 $28 $4,000 $700 $700 $700 $700 $700 $700 $700 $700 $700 $695 $570 $445 $320 $195 $70 $4,400 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $700 $586 $461 $336 $211 $86 Rates rebate Email delivery of rates Email rates@wmk.govt.nz from the email address that you would like your rates delivered to and confirm the rates assessment numbers that you would like to have emailed Direct Debit Visit waimakariri.govt.nz/online services or talk to Customer Services staff to set up a direct debit. Payments can be spread across the full 12 months of the rating year, and provided payments are kept up-to-date there will be no penalty charges. Payment Plans Our team can help set up a payment plan if it's becoming a challenge to keep up with rates payments. Email us at rates@wmk.govt.nz or phone 0800 965 468. waimakariri.govt.nz Do you Qualify for a Rates Rebate ? You Can Claim up to $ 700 Towards Your Rates If you have not claimed a rates rebate since July 2022 , check your eligibility here . The Rates Rebate Scheme provides up to $ 700 for low income households paying rates for the home they were living in on 1 July 2022 . The rebate is based on your gross household income for the tax year ending on 31 March 2022 and is for the 2022/23 rates year . Rates rebate income eligibility table - estimate only Gross household income $ 25,000- $ 34,000 $ 35,000 $ 36,000 $ 37,000 $ 38,000 $ 39,000 $ 40,000 $ 41,000 $ 42,000 $ 43,000 $ 44,000 $ 45,000 $ 46,000 $ 47,000 $ 48,000 $ 49,000 $ 50,000 $ 2,500 $ 2,750 $ 3,000 $ 700 $ 700 $ 700 $ 695 $ 700 $ 700 $ 570 $ 700 $ 445 $ 611 $ 320 $ 195 $ 70 $ 486 $ 361 $ 236 $ 111 WAIMAKARIRI Find out more at waimakariri.govt.nz DISTRICT COUNCIL Rates payable for the 2022/23 year $ 3,250 $ 3,500 $ 3,750 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 695 $ 700 $ 570 $ 700 $ 611 Use total annual rates . These figures are based on a household without dependent children , if you have dependents you may still qualify . Try the rates calculator at : $ 700 $ 700 $ 653 waimakariri.govt.nz/your-council/rates/rates-rebate-scheme . You need to bring accurate information about your gross household income for the tax year ended 31 March 2022. No evidence of income is needed if you have received a standard WINZ benefit or NZ Super for the whole tax year , although you will need evidence of the amount of any supplements received on top of the standard amount . Bring details of gross income from other sources including interest and dividends . $ 528 $ 403 $ 278 $ 153 If you hold a licence to occupy agreement in a retirement village you may also qualify for a rates rebate . Speak to your retirement . village operator . $ 445 $ 320 $ 195 $ 70 $ 486 $ 361 $ 236 $ 111 $ 700 $ 700 $ 700 $ 700 $ 653 $ 528 $ 403 $ 278 $ 153 $ 28 $ 4,000 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 695 $ 570 $ 445 $ 320 $ 195 $ 70 $ 4,400 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 700 $ 586 $ 461 $ 336 $ 211 $ 86 Rates rebate Email delivery of rates Email rates@wmk.govt.nz from the email address that you would like your rates delivered to and confirm the rates assessment numbers that you would like to have emailed Direct Debit Visit waimakariri.govt.nz/online services or talk to Customer Services staff to set up a direct debit . Payments can be spread across the full 12 months of the rating year , and provided payments are kept up - to - date there will be no penalty charges . Payment Plans Our team can help set up a payment plan if it's becoming a challenge to keep up with rates payments . Email us at rates@wmk.govt.nz or phone 0800 965 468 . waimakariri.govt.nz